ACA Forms

Affordable Care Act (ACA) regulations require employers to report healthcare coverage information to employees and the IRS using forms 1095-B and 1095-C. We also offer ACA envelopes that coordinate with the both forms.

1095-B

Employers, government agencies, and other health insurance issuers file Form 1095-B, Health Coverage, to report that their employee or an individual is enrolled in a sponsored plan that offers minimum essential health coverage for some or all of the tax year. Minimum essential coverage does not include coverage consisting solely of excepted benefits, such as vision and dental coverage not part of a comprehensive health insurance plan. Sponsored health insurance plans may include eligible employer-sponsored plans, such as a self-insured group health plan for employees or group health insurance coverage for employees under a governmental plan like the Federal Employees Health Benefits program. Additionally, sponsored health insurance plans may include government-sponsored programs such as Medicare Part A or certain Medicaid programs.

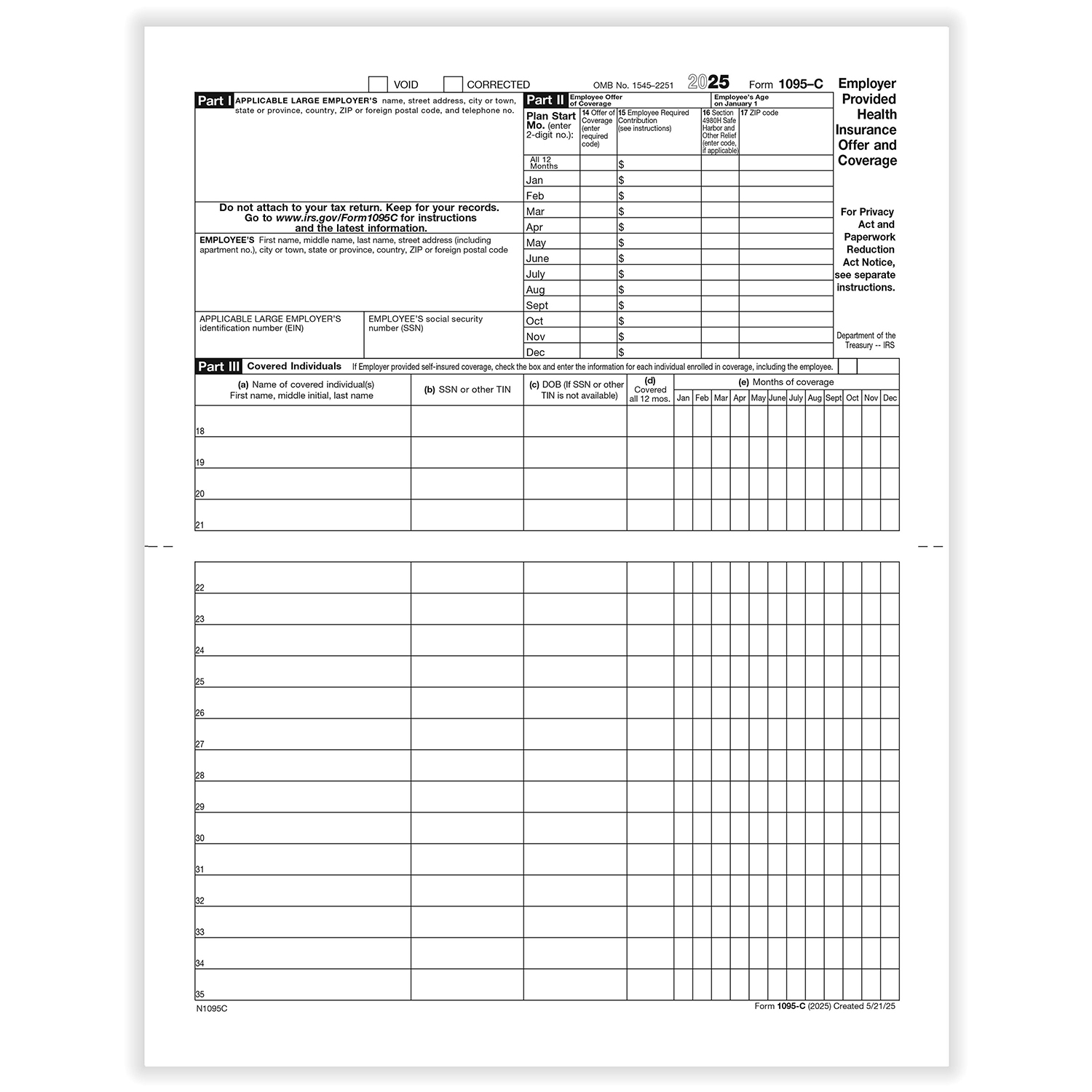

1095-C

Employers use Form 1095-C, Employer-Provided Health Insurance Offer and Coverage, to report the health insurance coverage offered to their employee during the tax year. Generally, applicable large employers (ALE) with 50 or more full-time employees (including full-time equivalent employees) in the preceding calendar year are required to file Form 1095-C and a transmittal Form 1094-C with the IRS. ALE Members that offer employer-sponsored, self-insured coverage also use Form 1095-C to report information to the IRS and to employees about individuals who have minimum essential coverage under the employer plan. Deadlines for Filing ACA Forms

2025 ACA Software by ComplyRight - DOWNLOAD

* Download software below

** Product Key available in README file (Download) in

My Account/Downloadable Products after Order is processed

** Product Key format xxxx xxxx xx25 **

* Product Download Instructions - Click Here!

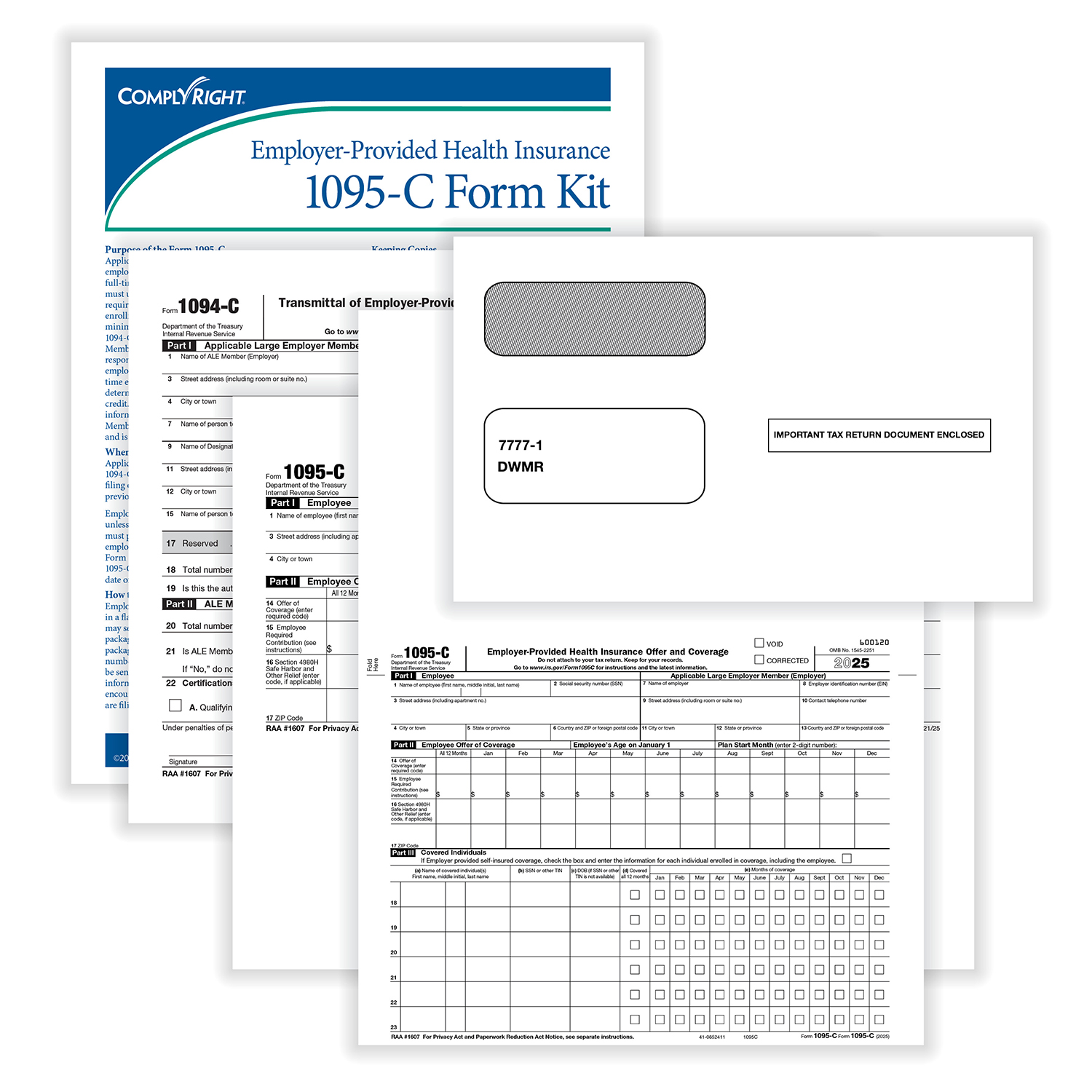

1095-C Kit w/ Envelopes – Pack of 50

• Pack size includes 50 1095-C forms (1095-C "Employer/Employee" Copy Employer-Provided Health Insurance Offer & Coverage and 1095-C "IRS" Copy Employer-Provided Health Insurance Offer & Coverage, Landscape)

• 3 1094-C Transmittals of Employer-Provided Health Insurance Offer and Coverage Information Returns

• Laser cut sheets

• Printed with heat-resistant ink for use with most inkjet and laser printers

• Contains tip sheet to take the guesswork out of the do's and don't of filing forms

• Included envelopes are double-window envelopes (gummed)

• Pack of 50 accommodates 50 employees

1095-C Employer Provided Health Insurance - Employee/Employer Copies - Bulk

• Includes 1095-C forms suitable for employee or employer copies

• Portrait format

• Laser cut sheets

• Printed with heat-resistant ink for use with most inkjet and laser printers

• 1 page equals 1 form

• Compatible envelopes are L0303 and L0304

This product offers tiered pricing, giving a lower price per form when you increase the quantity ordered. The table below shows pricing for Pack Size = 500.

1095-B & C Health Coverage Blank Pressure Seal 14"

• Blank form includes Backer Instructions can be used for either 1095-B or 1095-C forms suitable for employee or employer copies

• 14" Z-fold format does not require envelopes

• Produced on quality 28# paper to ensure trouble-free printing and folding

• Printed with heat-resistant ink for use with most inkjet and laser printers

• 1 page equals 1 form

• Pack of 500 forms

This product offers tiered pricing, giving a lower price per form when you increase the quantity ordered. The table below shows pricing for Pack Size = 500.

1095-B & C Health Coverage Blank w/Backer Instructions

1095-B & C Health Coverage Blank w/Backer Instructions

• Blank form includes Backer Instructions can be used for either 1095-B or 1095-C forms suitable for employee or employer copies

• Portrait format

• Laser-cut sheets

• Printed with heat-resistant ink for use with most inkjet and laser printers

• 1 page equals 1 form

• Pack of 50 forms

• Compatible envelopes are L1013 and L1012

This product offers tiered pricing, giving a lower price per form when you increase the quantity ordered. The table below shows pricing for Pack Size = 50.

If you are ordering more than 10,000 forms, please contact service@formstax.com for custom pricing.

1095-C Blank Tax Form with Backer (Bottom Half)

• Includes 1095-C forms suitable for employee or employer copies

• Portrait format

• Laser cut sheets

• Printed with heat-resistant ink for use with most inkjet and laser printers

• 1 page equals 1 form

• Compatible Envelope is L1013, L1012, L0303 and L0304

This product offers tiered pricing, giving a lower price per form when you increase the quantity ordered. The table below shows pricing for Pack Size = 50.

1095-C Blank Tax Form with Backer, Landscape, Laser

• Includes blank 1095-C forms suitable for employee or employer copies

• Landscape format

• Laser cut sheets

• Printed with heat-resistant ink for use with most inkjet and laser printers

• 1 page equals 1 form

• Compatible Envelope is L1013, L1012, L0303 and L0304

This product offers tiered pricing, giving a lower price per form when you increase the quantity ordered. The table below shows pricing for Pack Size = 500.

If you are ordering more than 10,000 forms, please contact service@formstax.com for custom pricing.

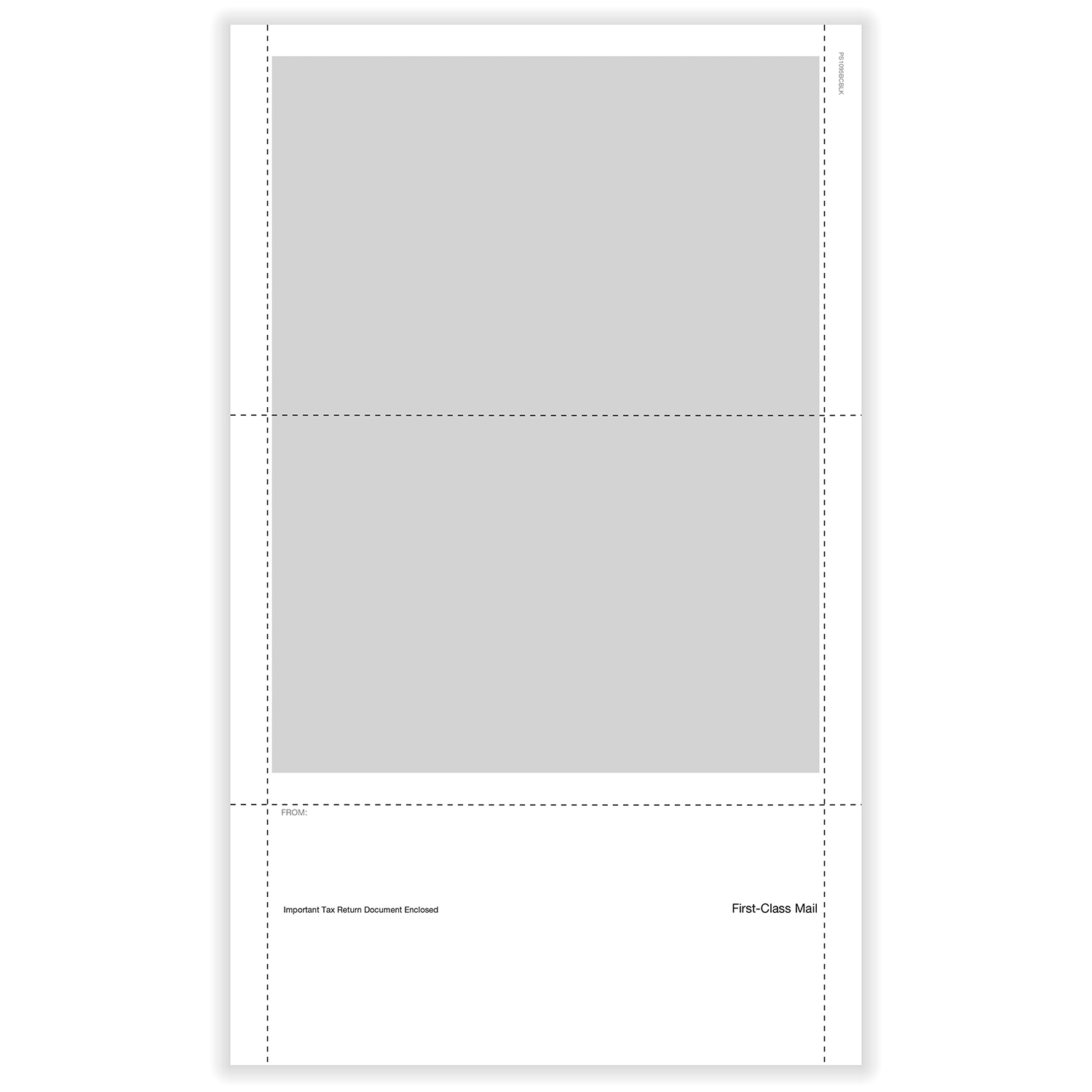

1099 Double-Window Envelopes - Gummed

• Double-window envelope accommodates all standard IRS 2-Up 1099 formats

• Overall size: 5-5/8" x 9" – Windows display both Payer and Recipient name and address

• Top window size: 3-3/8" x 1-1/8" - Position: 1/2" from left; 3-3/4" from bottom

• Bottom window size: 3-3/8" x 1-7/16" - Position: 1/2" from left; 1-1/2" from bottom

• Works with certain ACA tax forms (L0179 and L0111)

• Moisture/gum-seal flap See L1012 for self-seal latex flap

• Manufactured on 24# white wove paper

• SFI fiber sourcing certified

• Offered in pack sizes of 25, 50, and 500

• Previous SKU was L1312

This product offers tiered pricing, giving a lower price per form when you increase the quantity ordered. The table below shows pricing for Pack Size = 25.

1099 Double-Window Envelopes - Self Seal

• Double-window envelope accommodates all standard IRS 2-Up 1099 formats

• Overall size: 5-5/8" x 9" - Windows display both Payer and Recipient name and address

• Top window size: 3-3/8" x 1-1/8" - Position: 1/2" from left; 3-3/4" from bottom

• Bottom window size: 3-3/8" x 1-7/16" - Position: 1/2" from left; 1-1/2" from bottom

• Works with certain ACA tax forms (L0179 and L0111)

• Self-seal latex flap See L1013 for moisture/gum-seal flap

• Manufactured on 24# white wove paper

• SFI or FSC fiber sourcing certified

• Offered in pack sizes of 25, 50, and 500

• Previous SKU was L0741

This product offers tiered pricing, giving a lower price per form when you increase the quantity ordered. The table below shows pricing for Pack Size = 25.

Double-Window Envelopes for 1095-C Tax Forms (Custom) to Fit Alternate Format, Gum-Seal, 9" x 5-3/4"

• Gum-Seal

• Overall Size: 9" x 5-3/4"

• Double-Window envelopes accommodates 1095-C Tax Forms (Custom Alternate Format)

• Top window size: 3-1/2" x 7/8" - Position: 1/2" from left; 3-5/8" from the bottom

• Bottom window size: 3-1/2" x 11/16" - Position: 1/2" from left; 2-1/2" from the bottom

• Windows display both Payer and Recipient name and address

• Manufactured on 24# white woven paper

This product offers tiered pricing, giving a lower price per form when you increase the quantity ordered. The table below shows pricing for Pack Size = 50.

Double-Window Envelopes for 1095-C Tax Forms (Custom) to Fit Alternate Format, Self-Seal, 9" x 5-3/4"

• Self-Seal

• Overall Size: 9" x 5-3/4"

• Double-Window envelopes accomodates 1095-C Tax Forms (Custom Alternate Format)

• Top window size: 3-1/2" x 7/8" - Position: 1/2" from left; 3-5/8" from the bottom

• Bottom window size: 3-1/2" x 11/16" - Position: 1/2" from left; 2-1/2" from the bottom

• Windows display both Payer and Recipient name and address

• Manufactured on 24# white woven paper

This product offers tiered pricing, giving a lower price per form when you increase the quantity ordered. The table below shows pricing for Pack Size = 50.