0

You have no items in your shopping cart.

Search

1099-MISC

1099-MISC

Use Form 1099-MISC, miscellaneous income, to report payments made in the course of your business for each person to whom you paid at least $10 in royalties, or at least $600 in rents, prizes and awards, medical and health care payments, or other income payments. Additionally, you must also file Form 1099-MISC for each person for whom you backup withheld any federal income tax, regardless of the amount of the payment. However, beginning with 2020, 1099-NEC is used for reporting nonemployee compensation. We also offer 1099-MISC envelopes that coordinate with the different forms. Deadlines for Filing 1099-MISC

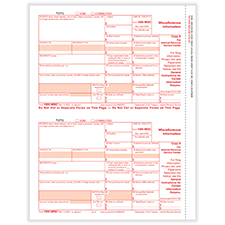

1099-MISC 2-Up Individual Federal Copy A

L0744

1099-MISC 2-Up Individual Federal Copy A

• 2-Up Federal Copy A

• Laser cut sheets

• Printed with heat-resistant ink for use with most inkjet and laser printers

• 1 page equals 2 forms

• Comes in packs of 50 and 100 forms

• Compatible envelopes are L1013 and L1012

This product offers tiered pricing, giving a lower price per form when you increase the quantity ordered. The table below shows pricing for Pack Size = 50.

If you are ordering more than 10,000 forms, please contact service@formstax.com for custom pricing.

• 2-Up Federal Copy A

• Laser cut sheets

• Printed with heat-resistant ink for use with most inkjet and laser printers

• 1 page equals 2 forms

• Comes in packs of 50 and 100 forms

• Compatible envelopes are L1013 and L1012

This product offers tiered pricing, giving a lower price per form when you increase the quantity ordered. The table below shows pricing for Pack Size = 50.

If you are ordering more than 10,000 forms, please contact service@formstax.com for custom pricing.

From $7.40

1099-MISC 2-Up Individual Recipient Copy B

L0751

1099-MISC 2-Up Individual Recipient Copy B

• 2-Up Copy B for Recipients' records

• Laser cut sheets

• Printed with heat-resistant ink for use with most inkjet and laser printers

• 1 page equals 2 forms

• Comes in packs of 50 and 100 forms

• Compatible envelopes are L1013 and L1012

This product offers tiered pricing, giving a lower price per form when you increase the quantity ordered. The table below shows pricing for Pack Size = 50.

If you are ordering more than 10,000 forms, please contact service@formstax.com for custom pricing.

• 2-Up Copy B for Recipients' records

• Laser cut sheets

• Printed with heat-resistant ink for use with most inkjet and laser printers

• 1 page equals 2 forms

• Comes in packs of 50 and 100 forms

• Compatible envelopes are L1013 and L1012

This product offers tiered pricing, giving a lower price per form when you increase the quantity ordered. The table below shows pricing for Pack Size = 50.

If you are ordering more than 10,000 forms, please contact service@formstax.com for custom pricing.

From $7.40

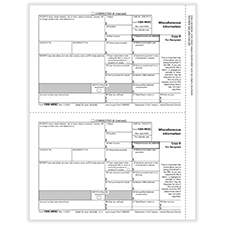

1099-MISC 2-Up Copy 2/1

L0759

1099-MISC 2-Up Copy 2/1

• 2-Up State Copy or Extra File Copy

• Laser cut sheets

• Printed with heat-resistant ink for use with most inkjet and laser printers

• 1 page equals 2 form

• Pack size of 100 forms

• Compatible envelope are L1013 and L1012

This product offers tiered pricing, giving a lower price per form when you increase the quantity ordered. The table below shows pricing for Pack Size = 100.

If you are ordering more than 10,000 forms, please contact service@formstax.com for custom pricing.

• 2-Up State Copy or Extra File Copy

• Laser cut sheets

• Printed with heat-resistant ink for use with most inkjet and laser printers

• 1 page equals 2 form

• Pack size of 100 forms

• Compatible envelope are L1013 and L1012

This product offers tiered pricing, giving a lower price per form when you increase the quantity ordered. The table below shows pricing for Pack Size = 100.

If you are ordering more than 10,000 forms, please contact service@formstax.com for custom pricing.

From $7.40

1099-MISC 3-Up Copy B & 2, Z-Fold, 11"

L0069

1099-MISC 3-Up Copy B & 2, Z-Fold, 11"

• 2-up horizontal 11” Pressure seal form with Copy B backer instructions

• Produced on Quality 28# paper to ensure trouble-free printing and folding

• Z-Fold format

• Pack of 500 forms

• 2-up horizontal 11” Pressure seal form with Copy B backer instructions

• Produced on Quality 28# paper to ensure trouble-free printing and folding

• Z-Fold format

• Pack of 500 forms

$162.00

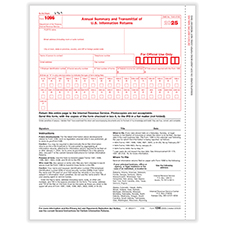

1096 Laser Transmittal

L0320

1096 Laser Transmittal

• Includes 1096 transmittal forms to show the totals of the information returns that you are physically mailing to the IRS

• Use to transmit paper forms 1098, 1099, 3921, 3922, 5498 and W-2-G to the IRS

• Printed with heat-resistant ink for use with most inkjet and laser printers

• Offered in pack sizes of 10 and 25

• Previous SKU was L0121

• Includes 1096 transmittal forms to show the totals of the information returns that you are physically mailing to the IRS

• Use to transmit paper forms 1098, 1099, 3921, 3922, 5498 and W-2-G to the IRS

• Printed with heat-resistant ink for use with most inkjet and laser printers

• Offered in pack sizes of 10 and 25

• Previous SKU was L0121

$3.95

1099-MISC 4-Part Form Set

L0740

1099-MISC 4-Part Form Set

• 4-Part set contains Copies A, B, and C/2

• Laser cut sheets

• 3 1096 Transmittal Forms included

• Printed with heat-resistant ink for use with most inkjet and laser printers

• Comes in pack of 25 forms

• Compatible envelopes are L1013 and L1012

• 4-Part set contains Copies A, B, and C/2

• Laser cut sheets

• 3 1096 Transmittal Forms included

• Printed with heat-resistant ink for use with most inkjet and laser printers

• Comes in pack of 25 forms

• Compatible envelopes are L1013 and L1012

$20.95

1099-MISC Recipient Copy Only 3-Part with Envelopes

L0411

1099-MISC Recipient Copy Only 3-Part with Envelopes

• 1099-MISC set includes copies B, C/1/2 and self-seal envelopes

• Laser cut sheets

• Printed with heat-resistant ink for use with most inkjet and laser printers

• 1 page equals 2 forms

• Comes in pack size of 50 forms

• 1099-MISC set includes copies B, C/1/2 and self-seal envelopes

• Laser cut sheets

• Printed with heat-resistant ink for use with most inkjet and laser printers

• 1 page equals 2 forms

• Comes in pack size of 50 forms

$34.95

1099-MISC 2-Up 3-Part Set w/ Self-Seal Envelopes

L0169

1099-MISC 2-Up 3-Part Set w/ Self-Seal Envelopes

• 2-Up 3-Part form set contains Copy A, B and C with self-seal envelopes

• 3 1096 Transmittal Forms included

• Laser cut sheets

• Printed with heat-resistant ink for use with most inkjet and laser printers

• 1 page equals 2 forms

• Pack size of 50 forms

• 2-Up 3-Part form set contains Copy A, B and C with self-seal envelopes

• 3 1096 Transmittal Forms included

• Laser cut sheets

• Printed with heat-resistant ink for use with most inkjet and laser printers

• 1 page equals 2 forms

• Pack size of 50 forms

$34.95

1099-MISC 2-Up 4-Part Set w/Gummed Envelopes

L0172

1099-MISC 2-Up 4-Part Set w/Gummed Envelopes

• 2-Up 4-Part form set contains Copies A, B, C/2 with gummed envelopes

• 3 1096 Transmittal Forms included

• Laser cut sheets

• Printed with heat-resistant ink for use with most inkjet and laser printers

• 1 page equals 2 forms

• Comes in pack sizes of 100 forms

• 2-Up 4-Part form set contains Copies A, B, C/2 with gummed envelopes

• 3 1096 Transmittal Forms included

• Laser cut sheets

• Printed with heat-resistant ink for use with most inkjet and laser printers

• 1 page equals 2 forms

• Comes in pack sizes of 100 forms

$43.95

1099-MISC 2-Up 4-Part Form + Self-Seal Envelopes

L0795

1099-MISC 2-Up 4-Part Form + Self-Seal Envelopes

• 2-Up 4-Part form set contains Copy A, B, and C with self-seal envelopes

• 3 1096 Transmittal Forms included

• Laser cut sheets

• Printed with heat-resistant ink for use with most inkjet and laser printers

• 1 page equals 2 forms

• Comes in packs of 25, 50 and 100 forms

• 2-Up 4-Part form set contains Copy A, B, and C with self-seal envelopes

• 3 1096 Transmittal Forms included

• Laser cut sheets

• Printed with heat-resistant ink for use with most inkjet and laser printers

• 1 page equals 2 forms

• Comes in packs of 25, 50 and 100 forms

$30.95

1099-MISC Blank Recipient Copy (Only), 3-Part with Envelopes

L0473

1099-MISC 2-Up Recipient Copy Only 3-Part Blank with Self-Seal Envelopes

• 1099-MISC set includes 2-Up blank form with 1 vertical perforation and 1 horizontal perforation and self-seal envelopes

• Laser cut sheets

• Printed with heat-resistant ink for use with most inkjet and laser printers

• 1 page equals 2 forms

• Comes in pack of 50 forms

• 1099-MISC set includes 2-Up blank form with 1 vertical perforation and 1 horizontal perforation and self-seal envelopes

• Laser cut sheets

• Printed with heat-resistant ink for use with most inkjet and laser printers

• 1 page equals 2 forms

• Comes in pack of 50 forms

$34.95

1099-MISC 3-Up Blank for Copies B and C with Printed Back - Horizontal

L0141

1099-MISC 3-Up Blank for Copies B and C with Printed Back - Horizontal

• 3-Up blank forms contain Copies B and C includes Backer Instructions, horizontal format

• Laser cut sheets

• Printed with heat-resistant ink for use with most inkjet and laser printers

• Pack size of 50 forms

• Compatible envelope is L1018

• 3-Up blank forms contain Copies B and C includes Backer Instructions, horizontal format

• Laser cut sheets

• Printed with heat-resistant ink for use with most inkjet and laser printers

• Pack size of 50 forms

• Compatible envelope is L1018

$16.95

1099-MISC 2-Up Blank w/Recipient Copy B with Backer Instructions w/stubs

L0135

1099-MISC 2-Up Blank w/Recipient Copy B with Backer Instructions w/stubs

• 2-Up blank form contains recipient Copy B with Backer Instructions with stubs

• Laser cut sheets

•Printed with heat-resistant ink for use with most inkjet and laser printers

• 1 page equals 2 forms

• Pack of 100 forms

• Compatible envelopes are L1013 and L1012

• 2-Up blank form contains recipient Copy B with Backer Instructions with stubs

• Laser cut sheets

•Printed with heat-resistant ink for use with most inkjet and laser printers

• 1 page equals 2 forms

• Pack of 100 forms

• Compatible envelopes are L1013 and L1012

$16.95

1099/W-2 Blank Face - Horizontal

L0133

1099/W-2 Blank Face - Horizontal

• Blank 1099/W-2 forms for use with software that prints the form image and data

• 3-Up Horizontal format form with stub perforation on right side

• Laser cut sheets

• Printed with heat-resistant ink for use with most inkjet and laser printers

• Pack size of 150 forms

• Compatible envelope is L1002 and L1010

• Blank 1099/W-2 forms for use with software that prints the form image and data

• 3-Up Horizontal format form with stub perforation on right side

• Laser cut sheets

• Printed with heat-resistant ink for use with most inkjet and laser printers

• Pack size of 150 forms

• Compatible envelope is L1002 and L1010

$16.95

1099 2-Up Blank Perforated

L1391

1099 2-Up Blank Perforated

• This form can be used as a 1099-MISC, 1099-INT, 1099-R, 1099-DIV and 1099-B

• 2-Up Blank form with 1 vertical perforation and 1 center-cross perforation

• Printed with heat-resistant ink for use with most inkjet and laser printers

• Pack size of 100 forms

• Compatible envelopes are L1013 and L1012

This product offers tiered pricing, giving a lower price per form when you increase the quantity ordered. The table below shows pricing for Pack Size = 100.

If you are ordering more than 40,000 forms, please contact service@formstax.com for custom pricing.

• This form can be used as a 1099-MISC, 1099-INT, 1099-R, 1099-DIV and 1099-B

• 2-Up Blank form with 1 vertical perforation and 1 center-cross perforation

• Printed with heat-resistant ink for use with most inkjet and laser printers

• Pack size of 100 forms

• Compatible envelopes are L1013 and L1012

This product offers tiered pricing, giving a lower price per form when you increase the quantity ordered. The table below shows pricing for Pack Size = 100.

If you are ordering more than 40,000 forms, please contact service@formstax.com for custom pricing.

From $7.50

1099-MISC Blank Pressure Seal 11" Z-Fold with Backer Instructions

L0140

1099-MISC Blank Pressure Seal 11" Z-Fold with Backer Instructions

• 2-up horizontal 11” Pressure seal form

• Produced on Quality 28# paper to ensure trouble-free printing and folding

• Z-Fold format

• Pack of 500 forms

• 2-up horizontal 11” Pressure seal form

• Produced on Quality 28# paper to ensure trouble-free printing and folding

• Z-Fold format

• Pack of 500 forms

$162.00

1099-MISC 2-Up Blank w/Recipient Copy B with Backer Instructions

L0115

1099-MISC 2-Up Blank w/Recipient Copy B with Backer Instructions

• 2-Up blank form contains recipient Copy B with Backer Instructions

• Laser cut sheets

• Printed with heat-resistant ink for use with most inkjet and laser printers

• 1 page equals 2 forms

• Pack of 50 forms

• Compatible envelopes are L0309

This product offers tiered pricing, giving a lower price per form when you increase the quantity ordered. The table below shows pricing for Pack Size = 50.

If you are ordering more than 10,000 forms, please contact service@formstax.com for custom pricing.

• 2-Up blank form contains recipient Copy B with Backer Instructions

• Laser cut sheets

• Printed with heat-resistant ink for use with most inkjet and laser printers

• 1 page equals 2 forms

• Pack of 50 forms

• Compatible envelopes are L0309

This product offers tiered pricing, giving a lower price per form when you increase the quantity ordered. The table below shows pricing for Pack Size = 50.

If you are ordering more than 10,000 forms, please contact service@formstax.com for custom pricing.

From $7.40

1099 Double-Window Envelopes 3-Up (Gummed)

L1002

1099 Double-Window Envelopes 3-Up (Gummed)

• Double-window envelope accommodates all standard IRS 3-Up 1099 formats

• Overall size: 3-7/8" x 8 7/8" - Windows display both Payer and Recipient name and address

• Top window size: 3-3/8" x7/8" - Position: 1/2" from left; 2-1/4" from bottom

• Bottom window size: 3-3/8" x 1-1/16" - Position: 1/2" from left; 11/16" from bottom

• Moisture/gum-seal flap

• Manufactured on 24# white wove paper

• Offered in pack sizes of 25, 50, and 500

• Previous SKU was L0114

This product offers tiered pricing, giving a lower price per form when you increase the quantity ordered. The table below shows pricing for Pack Size = 25.

• Double-window envelope accommodates all standard IRS 3-Up 1099 formats

• Overall size: 3-7/8" x 8 7/8" - Windows display both Payer and Recipient name and address

• Top window size: 3-3/8" x7/8" - Position: 1/2" from left; 2-1/4" from bottom

• Bottom window size: 3-3/8" x 1-1/16" - Position: 1/2" from left; 11/16" from bottom

• Moisture/gum-seal flap

• Manufactured on 24# white wove paper

• Offered in pack sizes of 25, 50, and 500

• Previous SKU was L0114

This product offers tiered pricing, giving a lower price per form when you increase the quantity ordered. The table below shows pricing for Pack Size = 25.

From $5.25

1099 Double-Window Envelopes 2-Up Diagonal – Gummed

L1009

1099 Double-Window Envelopes 2-Up Diagonal – Gummed

• Double-window envelope accommodates all standard IRS 2-Up 1099 formats

• Overall size: 5-5/8" x 9" - Windows display both Payer and Recipient name and address

• Top window size: 3-3/8" x 1-1/8" - Position: 1/2" from left; 3-3/4" from bottom

• Bottom window size: 3-3/8" x 1-7/16" - Position: 1/2" from left; 1-1/2" from bottom

• Diagonal moisture/gum seal flap works better with certain high-speed insert machines

• Manufactured on 24# white wove paper

• SFI fiber sourcing certified

• Offered in pack sizes of 25, 50, and 500

• Previous SKU was L0187

• Double-window envelope accommodates all standard IRS 2-Up 1099 formats

• Overall size: 5-5/8" x 9" - Windows display both Payer and Recipient name and address

• Top window size: 3-3/8" x 1-1/8" - Position: 1/2" from left; 3-3/4" from bottom

• Bottom window size: 3-3/8" x 1-7/16" - Position: 1/2" from left; 1-1/2" from bottom

• Diagonal moisture/gum seal flap works better with certain high-speed insert machines

• Manufactured on 24# white wove paper

• SFI fiber sourcing certified

• Offered in pack sizes of 25, 50, and 500

• Previous SKU was L0187

$12.95

1099 Double-Window Envelopes - Gummed

L1013

1099 Double-Window Envelopes - Gummed

• Double-window envelope accommodates all standard IRS 2-Up 1099 formats

• Overall size: 5-5/8" x 9" – Windows display both Payer and Recipient name and address

• Top window size: 3-3/8" x 1-1/8" - Position: 1/2" from left; 3-3/4" from bottom

• Bottom window size: 3-3/8" x 1-7/16" - Position: 1/2" from left; 1-1/2" from bottom

• Works with certain ACA tax forms (L0179 and L0111)

• Moisture/gum-seal flap See L1012 for self-seal latex flap

• Manufactured on 24# white wove paper

• SFI fiber sourcing certified

• Offered in pack sizes of 25, 50, and 500

• Previous SKU was L1312

This product offers tiered pricing, giving a lower price per form when you increase the quantity ordered. The table below shows pricing for Pack Size = 25.

• Double-window envelope accommodates all standard IRS 2-Up 1099 formats

• Overall size: 5-5/8" x 9" – Windows display both Payer and Recipient name and address

• Top window size: 3-3/8" x 1-1/8" - Position: 1/2" from left; 3-3/4" from bottom

• Bottom window size: 3-3/8" x 1-7/16" - Position: 1/2" from left; 1-1/2" from bottom

• Works with certain ACA tax forms (L0179 and L0111)

• Moisture/gum-seal flap See L1012 for self-seal latex flap

• Manufactured on 24# white wove paper

• SFI fiber sourcing certified

• Offered in pack sizes of 25, 50, and 500

• Previous SKU was L1312

This product offers tiered pricing, giving a lower price per form when you increase the quantity ordered. The table below shows pricing for Pack Size = 25.

From $5.25

1099-MISC Double Window Envelope 3-Up

L1018

1099-MISC Double Window Envelope 3-Up

• Double-window envelope accommodates 3-Up 1099-MISC forms

• This envelope accommodates continuous and laser 1099, 1098, and W-2G forms (except Form 1098-C, 1099-MISC, 1099-INT, 1099-R, 1099-B, 1099-K, and 1099-DIV)

• Overall Size: 8.875" W x 3.875" H

• Top Window: 3.375" x .9375" Position: .4375" from left 2.25" from bottom

• Bottom Window: 3.375" x .8125" Position: .4375" from left .75" from bottom 3-78" x 8-3/8"

• Moisture/gum-seal flap

• Double-window envelope accommodates 3-Up 1099-MISC forms

• This envelope accommodates continuous and laser 1099, 1098, and W-2G forms (except Form 1098-C, 1099-MISC, 1099-INT, 1099-R, 1099-B, 1099-K, and 1099-DIV)

• Overall Size: 8.875" W x 3.875" H

• Top Window: 3.375" x .9375" Position: .4375" from left 2.25" from bottom

• Bottom Window: 3.375" x .8125" Position: .4375" from left .75" from bottom 3-78" x 8-3/8"

• Moisture/gum-seal flap

$11.95

1099 Double-Window Envelopes - Self Seal

L1012

1099 Double-Window Envelopes - Self Seal

• Double-window envelope accommodates all standard IRS 2-Up 1099 formats

• Overall size: 5-5/8" x 9" - Windows display both Payer and Recipient name and address

• Top window size: 3-3/8" x 1-1/8" - Position: 1/2" from left; 3-3/4" from bottom

• Bottom window size: 3-3/8" x 1-7/16" - Position: 1/2" from left; 1-1/2" from bottom

• Works with certain ACA tax forms (L0179 and L0111)

• Self-seal latex flap See L1013 for moisture/gum-seal flap

• Manufactured on 24# white wove paper

• SFI or FSC fiber sourcing certified

• Offered in pack sizes of 25, 50, and 500

• Previous SKU was L0741

This product offers tiered pricing, giving a lower price per form when you increase the quantity ordered. The table below shows pricing for Pack Size = 25.

• Double-window envelope accommodates all standard IRS 2-Up 1099 formats

• Overall size: 5-5/8" x 9" - Windows display both Payer and Recipient name and address

• Top window size: 3-3/8" x 1-1/8" - Position: 1/2" from left; 3-3/4" from bottom

• Bottom window size: 3-3/8" x 1-7/16" - Position: 1/2" from left; 1-1/2" from bottom

• Works with certain ACA tax forms (L0179 and L0111)

• Self-seal latex flap See L1013 for moisture/gum-seal flap

• Manufactured on 24# white wove paper

• SFI or FSC fiber sourcing certified

• Offered in pack sizes of 25, 50, and 500

• Previous SKU was L0741

This product offers tiered pricing, giving a lower price per form when you increase the quantity ordered. The table below shows pricing for Pack Size = 25.

From $8.45